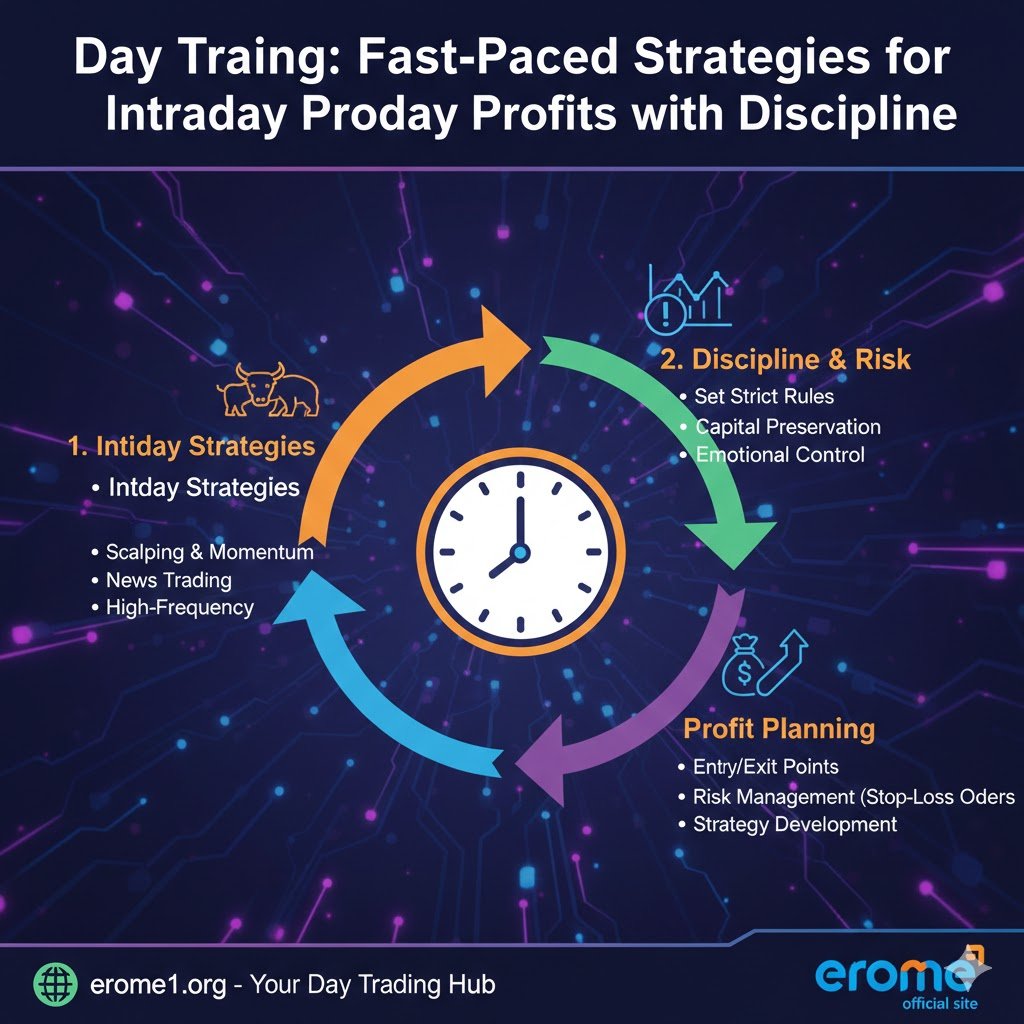

What Day Trading Really Means

Day trading is a trading style where positions are opened and closed within the same day. Traders aim to profit from small price movements. This type of trading is fast paused and requires focus. Day trading is not about guessing. It is about planning timing and strong discipline.

Why Speed and Timing Matter

In day trading timing is everything. Prices move quickly and chances appear for short moments. Traders who react late often miss profit. Fast decisions must still follow rules. Speed without control leads to losses. This is why preparation before market open is very important.

Simple Intraday Trading Strategies

One common strategy is breakout trading. Traders enter when price breaks an important level. Another method is trend continuation where traders follow market direction. These strategies work best when market is active. Beginners should keep strategies simple and repeatable.

Importance of Market Preparation

Successful day traders prepare before trading starts. They check market news price levels and overall trend. Preparation reduces stress during live trading. A clear plan helps avoid emotional decisions. Good preparation turns fast markets into manageable opportunities.

Discipline as the Core Skill

Discipline separates winners from losers in day trading. Many traders know strategies but fail due to lack of control. Discipline means following rules even after losses. It also means stopping when daily loss limit is reached. Without discipline profits never last.

Risk Control for Intraday Trades

Risk management is critical in fast trading. Traders should risk only a small part of capital per trade. Stop loss must always be used. Intraday markets can reverse quickly. Protecting capital allows traders to survive bad days and learn.

Emotional Control During Fast Markets

Fast price movement creates excitement and fear. Greed pushes traders to overtrade. Fear causes early exits. A calm mindset improves results. Taking breaks helps reset focus. Emotional balance is a hidden skill in day trading.

Common Mistakes New Day Traders Make

Many beginners trade too much in one day. Others increase position size after a loss. Some ignore stop loss hoping market will return. These mistakes drain accounts fast. Learning patience saves money and confidence.

Building Consistency Over Time

Day trading success comes from consistency not one big win. Small daily gains add up over time. Journaling trades helps find mistakes. Improving one step at a time builds strong habits. Consistent effort beats random luck.

Final Thoughts on Day Trading

Day trading offers intraday profit chances with high speed action. It also demands discipline planning and emotional control. Beginners should focus on learning not rushing. With practice and patience day trading can become a controlled and rewarding skill.